Search results : financial crisis

2018-10-19 13:37:00 Friday ET

2018-09-30 14:34:00 Sunday ET

2018-09-23 08:37:00 Sunday ET

2018-09-07 07:33:00 Friday ET

2018-08-19 10:34:00 Sunday ET

2018-08-17 11:45:00 Friday ET

2018-07-17 08:35:00 Tuesday ET

2018-06-14 10:35:00 Thursday ET

2018-05-27 08:33:00 Sunday ET

2018-05-21 07:39:00 Monday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-21 11:32:00 Tuesday ET

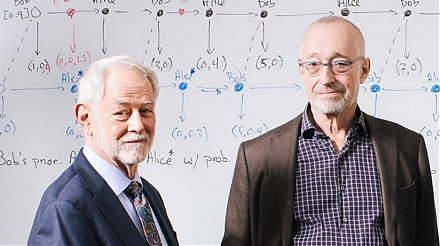

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2018-12-05 09:38:00 Wednesday ET

Federal Reserve publishes its inaugural flagship financial stability report. Fed Chair Jerome Powell applauds both low inflation (2%) and low unemployment (

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t